Within the Summer Statement, one of the Chancellor’s key announcements was the 8-month Stamp Duty Land Tax (SDLT) holiday, to help get the housing sector moving.

The holiday applies to purchases of residential property in England and Northern Ireland, up to the value of £500,000, that complete between the period 8 July 2020 to 31 March 2021.

Previously, if you bought a property and you did not already own a property, or you were replacing your main residence, you would pay no SDLT on the first £125,000. The new rules mean this has been significantly increased to £500,000.

Therefore, for individuals buying a property with a value of £500,000 this would provide them with a SDLT saving of £15,000.

The property does not have to be a main residence, if you don’t currently own a property and are looking to acquire an investment property, these rules would apply. However, you may want to take some advice on the wider position and your future plans first.

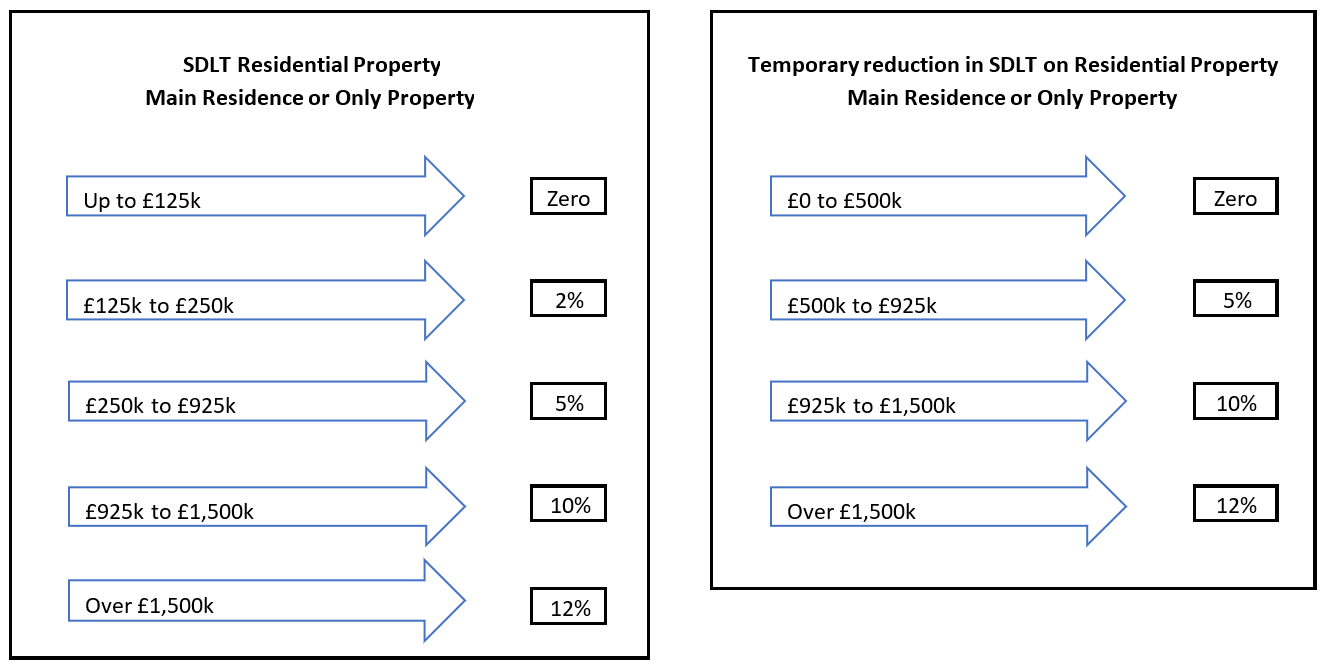

The SDLT rates for main residence purchases or only property purchases, before and after the Chancellor’s announcement are as follows:

The new temporary rates apply even if you have owned property before unlike First Time Buyers Relief. However, if an individual already owns property and is looking to acquire a further property, then the 3% surcharge will still apply. As the rules state, if two properties are owned at the end of the day of completion, the 3% surcharge will apply.

There are provisions where you are replacing your main residence which should be considered and if you are acquiring a new main residence before selling your previous residence, and already own a second property, within certain time limits of your previous main residence being sold, you can claim a refund of the 3% surcharge. There is a three-year looking back and forwards rule you should seek advice on and consider with regards to the replacement of a main residence.

Where you are looking to acquire additional property during the SDLT holiday period, then you can still make substantial SDLT savings. This is because the surcharge rate remains at 3% up to £500,000 during this time, compared with up to £125,000. The SDLT holiday therefore still provides a saving for those landlords and investors looking to add to their property portfolio, and whom may have previously looked at property of a value up to £125,000 or less to keep within the 3% surcharge, before the SDLT rates kick in and the 3% is payable in addition to this.

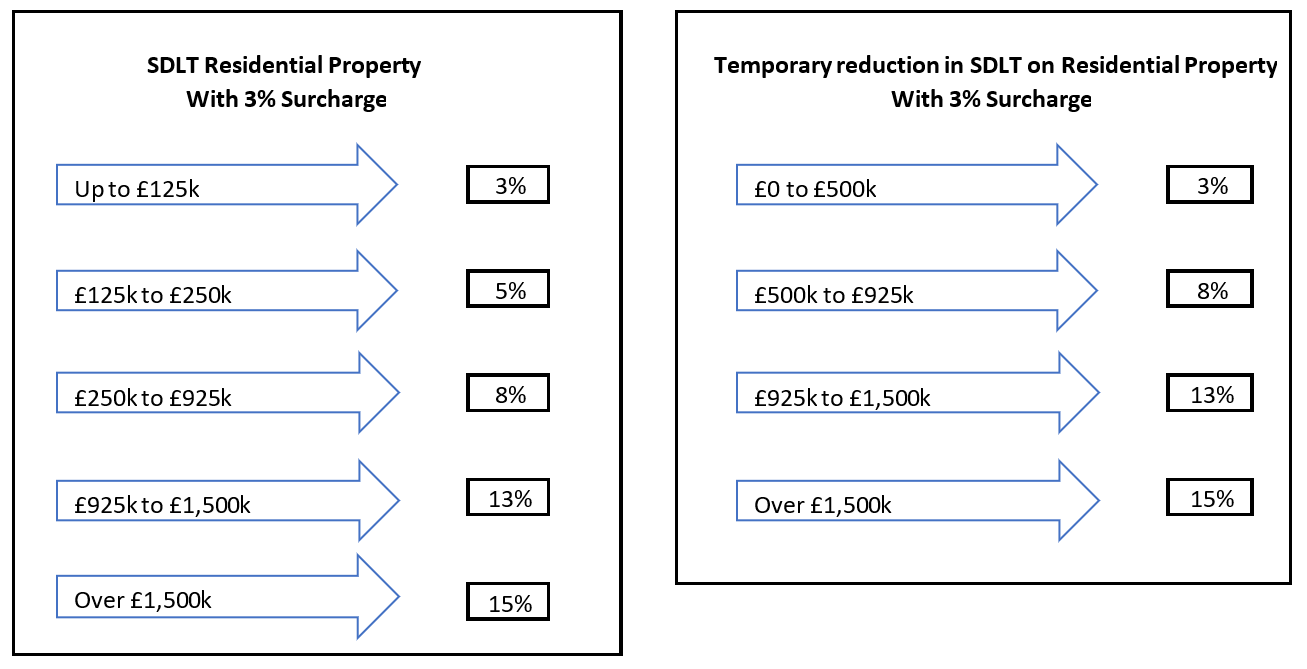

The SDLT rates as applied to additional property purchases before and after the Chancellor’s announcement are as follows:

What about new Leasehold sales and transfers?

The nil rate band which applies to the net present value of any rents payable for residential property is also increased to £500,000, with no SDLT payable up to this amount and 1% over this.

How does it work for lease extensions?

In addition, the same principles apply to the payments made for residential lease extensions. Often there will be no SDLT to pay where the premium payable for the extended lease does not exceed £500,000, however care needs to be taken in case the 3% surcharge applies. This could be the case if the lessee (or a spouse / civil partner) has other property interests.

Can I still claim First Time Buyers Relief?

The relief is suspended during the holiday period, however, this does not matter as the new temporary rates are more generous than the relief (which merely increases the threshold to £300,000). The relief will be reactivated on 1 April 2021.

Can you still claim relief on the purchase of a home with an annex?

Many people will be aware that you can claim a relief known as Multiple Dwellings Relief (MDR) when you acquire more than one property and that when conditions are met, you can apply this relief to the purchase of a home with an annex. What this means is as opposed to paying SDLT on the total value, the average price per dwelling is taken, reducing the SDLT payable. You can still make a claim for MDR, however, you should be aware the new temporary rates mean in a few cases more tax is payable if you claim the relief and therefore comparison calculations with and without the relief should be undertaken.

What about purchases of non-residential and mixed property?

The rates for non-residential and mixed property are unaffected. It is worth noting where a property has mixed residential and commercial use, the non-residential rates apply to the whole purchase, the price is not apportioned between the two types of use as it may be for other tax calculations.

Due to the temporary residential rate changes, buyers will pay more SDLT on mixed property for purchases under £1,215,000 than compared with residential property. However, there is no election that can be made to apply residential rates like there is if you acquire more than one property and you can choose whether to claim MDR or not.

What about the rates for the purchase of 6 or more dwellings in a single transaction?

The purchase of six or more dwellings in a single transaction continues to be taxed at the non-residential rates unless a claim for MDR is made. This applies equally to the purchase of a building composed of 10 flats and to the purchase of 10 houses. The new temporary rates give a benefit per property where MDR is claimed.

What if you are Non-Resident?

If you are non-UK Resident you can still benefit from the SDLT holiday but for purchases after 1 April 2021, you will not only lose the SDLT holiday but also suffer an additional 2% surcharge. This means that if you are a non-UK resident and purchase an additional dwelling after 1 April 2021, you will suffer a total surcharge of 5%. Overseas buyers will therefore be subject to a top rate of 17% SDLT of the purchase price. This will be either a flat rate of 17% in the case of those with existing property, 15% higher rate on companies buying a dwelling or in other cases, on the top slice of the purchase price above £1.5m.

What if you are acquiring property within a trust?

The SDLT position will very much depend on the type of trust being used, broadly speaking with a bare trust or interest in possession trust, the position of the beneficiary will be reviewed to determine if this is the only property owned at completion, a replacement of a main home or additional property, to determine if the SDLT holiday can apply in full or the 3% surcharge will apply.

For discretionary trusts the 3% surcharge for SDLT will apply to all purchases including the first purchase.

If you already have a trust set up or are considering the use of a trust then advice should be sought to fully understand all of the rules.

Who can benefit from the SDLT holiday?

The holiday can benefit many property purchases, provided individuals complete on the purchase during the holiday and where there are second property purchases the 3% surcharge is taken into account. The holiday is not limited to homebuyers but investors, landlords and developers can benefit.

Companies will also benefit, they will still be subject to the 3% surcharge on all purchases including the first purchase, but as outlined this can still provide substantial savings when comparing the new £500k band to the previous £125k band. There is an exception where individuals use companies to purchase dwellings worth more than £500,000 for owner-occupation and in that case, a flat 15% rate applies to the price.

Where completion happened before 8 July 2020, the holiday does not apply and where completion happens after 31 March 2021, even if exchange happens before that date, the holiday will not apply unless the contract is substantially performed, before 1 April 2021; i.e. such as taking possession but you would want to seek professional advice if this was the case.

It is worth noting, different rules apply to purchases of property in the rest of the UK.

In addition, the holiday can benefit transactions of existing dwellings such as transfers of equity and where mortgages are transferred and subject to SDLT.

Planning Opportunities

The SDLT holiday does mean it is a good time for many to assess their position and consider implementing some planning. Many may consider house prices will look to continue to drop, perhaps especially after the end of the SDLT holiday and therefore now is a good time to sell whilst the market is incentivised.

This could be a welcome opportunity for many looking to undertake Inheritance Tax planning, for example where funds are tied up in a large family home and a family wish to downsize and release funds to gift to family or invest in assets which attract Inheritance Tax Relief, and therefore removing value from their estate which would otherwise be subject to Inheritance Tax at 40%.

In addition, those considering transferring properties into limited companies may also benefit, with landlords having seen numerous changes to the tax rules which has meant many now consider owning property in a company where the tax rules can be more attractive compared with owning them personally.

If you own property and would like to take stock of your position and consider planning for the future, then please get in touch. Our experienced tax team will be happy to help.