A timeline for Making Tax Digital

A timeline for Making Tax Digital

Expert insight and news straight to your inbox

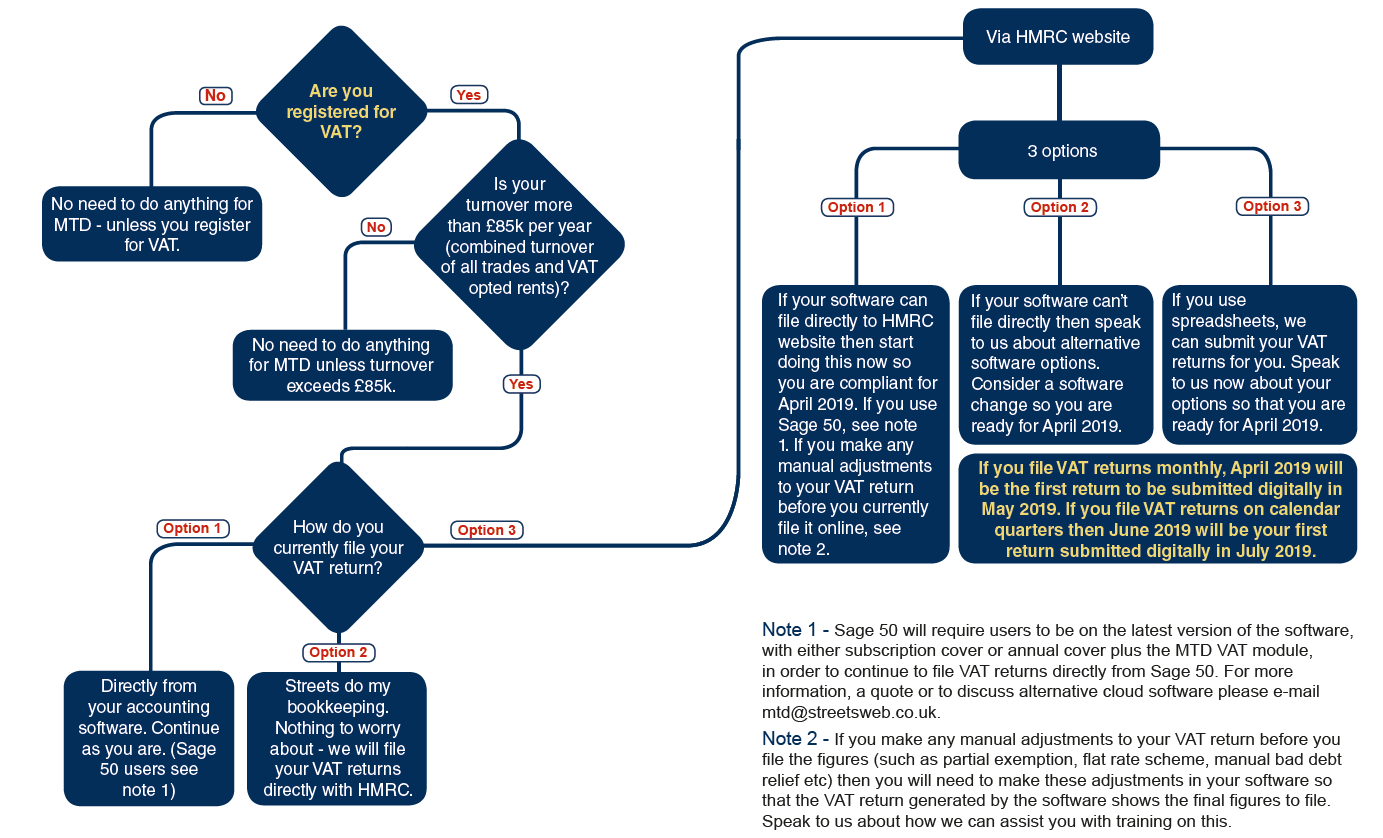

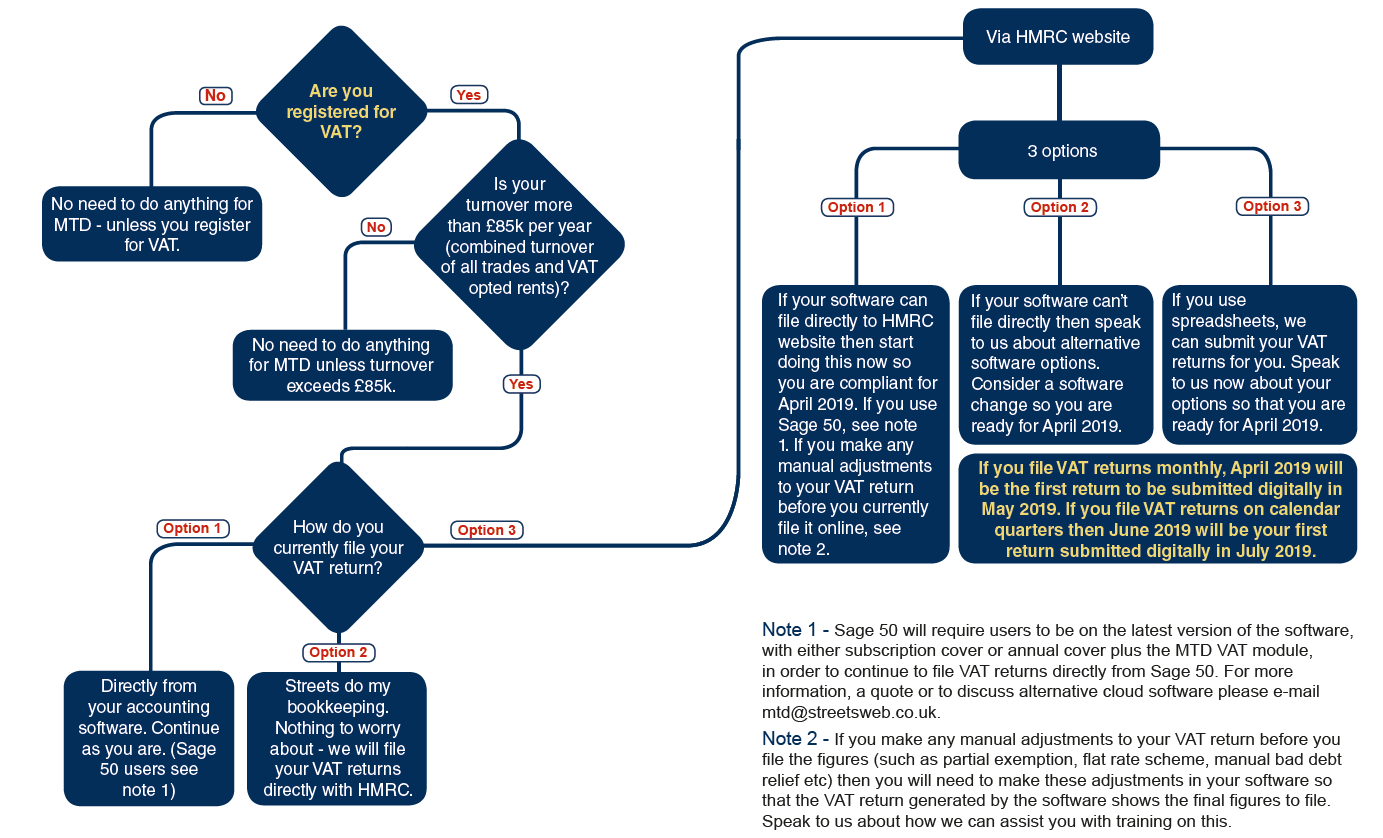

Subscribe to our newsletterWhen MTD for VAT came into effect in April 2019, it introduced the requirement for VAT registered businesses with a turnover above the VAT threshold to keep the records in a digital format and submit their VAT returns via software.

Making Tax Digital (MTD) for VAT makes it mandatory for most VAT Registered businesses to keep electronic records and submit VAT Returns through compatible software. This commences from the first VAT period starting on or after 1 April 2019.

Record payments based on supplier statements rather than invoices Historically, businesses have been required to record every single purchase …