The deadline for submitting your 2020/2021 Self Assessment Tax Return online is 31 January 2022 and there is not expected to be an extension like 2019/2020. An automatic £100 late filing penalty will apply if submitted late without a reasonable excuse.

Those who regularly submit tax returns will be familiar with the usual requirements for what they need to declare or what they can claim on their Self Assessment Tax Returns, but there are extra considerations to take into account this year as a result of the pandemic.

The 2020/2021 tax year is the first year that you may have received grant income and it is likely that this income needs to be included somewhere on your tax return.

Self Employment Income Support Scheme (SEISS) Grants

These grants are taxable in the year in which they were received. This means, if received, the first three grants, at least, will be included on the 2020/2021 tax return. There are extra boxes on this year’s return for the SEISS grants.

If you are a sole trader, they should be included in box 70.1 of the self employment pages. If you are a partner in a partnership and you retained the grant yourself, they should be included in box 9.1 of the partnership pages.

If a grant was paid into your partnership and not retained by the individual partner, then it is included in the partnership accounts and forms part of your normal trading profits, therefore it will depend on your accounting period as to which tax year it falls in.

Taxpayers need to not only declare the correct SEISS grants they received on their Self Assessment Tax Return, but they also need to consider whether they have been correctly claimed in the first place.

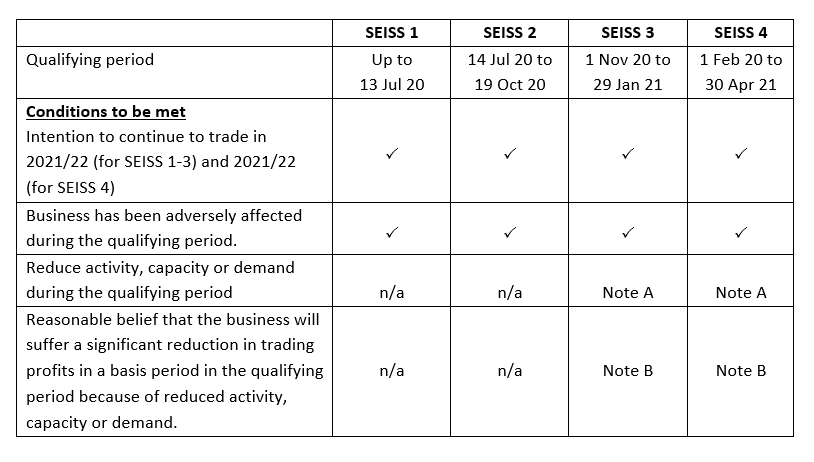

Certain conditions had to be met for each grant and to complicate matters those conditions were different for each grant. The table below, we hope, is a helpful summary:

Note A: this condition will be met where sales are reduced in the qualifying period and the reduction can be compared with what could reasonably have been expected but for the adverse effect of coronavirus

Note B: this condition will be met where there has been a significant reduction in trading profits over at least one whole basis period

If you feel that any payments have been incorrectly claimed and wish to discuss this further you should contact your accountant or tax advisor for advice. There is a place on the tax return to repay any grants incorrectly claimed.

Other Grants

If your business has employees, you may have received Coronavirus Job Retention Scheme (CJRS) grants and these payments are taxable and will need to be included as other business income.

The £500 test and trace and self isolation payments are also taxable. If you are employed they should be included in the “other benefits” box on the “benefits from you employment” section of the employment pages. If you are self-employed you should include the amount in box 16 (other business income) on the self employment pages.

Restart grants are taxable in the year in which they are received and should be included as other business income.

Any payments received under the Eat Out to Help Out scheme should also be included when calculating taxable profits as other business income.

Coronavirus Business Support Grants are also taxable. These are grants paid by local authorities and include the Small Business Grant Fund, the Retail, Hospitality and Leisure Grant Fund, the Local Authority Discretionary Grant Fund and the Fisheries Response Fund.

Finally on the subject of grants, there is an additional declaration that you are required to make this year if you have received any coronavirus related grant. You can make this declaration by ticking box 20.1 on the tax return. This confirms you have included all relevant coronavirus grants received.

Working from home claim

Employers can pay up to £6 per week tax free to their employees to cover their increased household costs as a result of working from home.

Employees who are not paid by their employer can instead claim tax relief on £6 per week. This is done by claiming £312 as an expense against your employment income. You can claim a full year’s worth for 2020/2021 (and 2021/2022) regardless of how many days you worked from home, as long as you were required to work from home at some point during the year. This claim can save up to £125 in tax.

Additional Information Notes

A sometimes underused tool of the tax return is the “white space note”. Although it is debated amongst the tax profession whether HM Revenue & Customs (HMRC) actually read these additional information notes, they can be a useful inclusion if you want to provide extra information relevant to anything on your return. Furthermore, if your return gets picked up for an enquiry, the additional information notes provided may pre-empt many of HMRC’s questions.

Time to pay

As tax advisors we always prefer to get your tax return submitted sooner rather than later where possible. This is not just for our benefit (to avoid a January rush) but so that you know well in advance what your tax position is. This could mean accelerating a tax refund due to you or giving you more time to plan for the payment of any unexpected tax liabilities due on 31 January.

If you are expecting to encounter difficulty in paying an upcoming tax payment, the advice from HMRC is to contact them as soon as possible and you are encouraged to do so before the payment becomes due. This can help avoid late payment penalties. HMRC has a dedicated line for arranging payment plans. In our experience, HMRC have been very reasonable when it comes to collecting tax providing you open up a dialogue with them. Most of their advisors have an understanding of the cash flow difficulties that the pandemic has caused taxpayers and the self employed in particular. They will discuss your financial position with the aim of agreeing a manageable payment plan.

It is also worth remembering that it is still possible to set up a payment plan online to pay tax over 12 months if the amount due is under £30,000. See https://www.gov.uk/difficulties-paying-hmrc/pay-in-instalments for more details.

Help is at hand

You can appreciate from the above that there are potentially a lot more traps in completing your tax return this year. By appointing an agent to complete your return and supplying them with all the relevant information you can reduce the risk of poor compliance, but remember the accuracy of a tax return remains the taxpayer’s own responsibility.

If you would like help with any of the above, please do get in touch with our experienced tax team by emailing tax@streetsweb.co.uk