Furlough claims can be made before, during or after you process your payroll as long as your claim is submitted by the relevant claim deadline.

You cannot submit your claim more than 14 days before your claim period end date.

When making your claim:

- you do not have to wait until the end date of the claim period for a previous claim before making your next claim

- you can make your claim more than 14 days in advance of the pay date (for example, if you pay your employee in arrears)

If you do not finish your claim in one session, you can save a draft. You must complete your claim within seven days of starting it.

Claims must be submitted by 23:59 14 calendar days after the month you’re claiming for. If this time falls on the weekend or a bank holiday then claims should be submitted on the next working day.

The table below details the dates for making new claims:

For claims relating to periods after 1 November 2020, you will only be able to increase the amount of your claim if you amend the claim within 28 calendar days after the month the claim relates to (unless this falls on a weekend or a bank holiday, it would then be the next working day.)

Claim amendments

If you made an error in your claim that has resulted in you receiving too little money, you will still need to make sure you pay your employees the correct amount. You should contact HMRC to amend your claim and as you are increasing the amount of your claim, they may need to conduct additional checks.

You can no longer:

- submit any further claims for periods ending on or before 31 October 2020

- add to existing claims for periods on or before 31 October 2020

For claims relating to periods after 1 November 2020, you will only be able to increase the amount of your claim if you amend the claim within 28 calendar days after the month the claim relates to (unless this falls on a weekend or a bank holiday, it would then be the next working day).

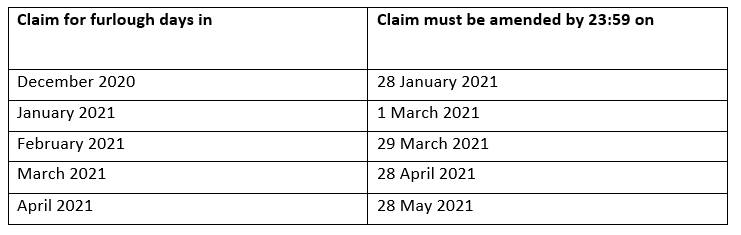

The table below details the deadlines for claim amendments: