On 31st October 2020 the Coronavirus Job Retention Scheme and furlough will come to an end and the new Job Support Scheme will come into effect. This new scheme will run for 6 months from 1st November 2020 to 30th April 2021.

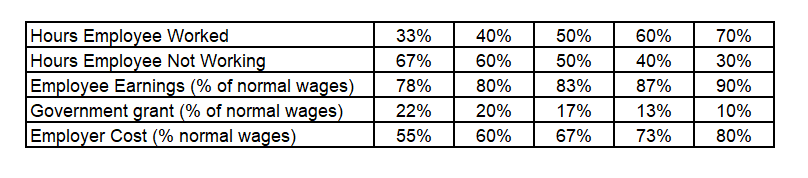

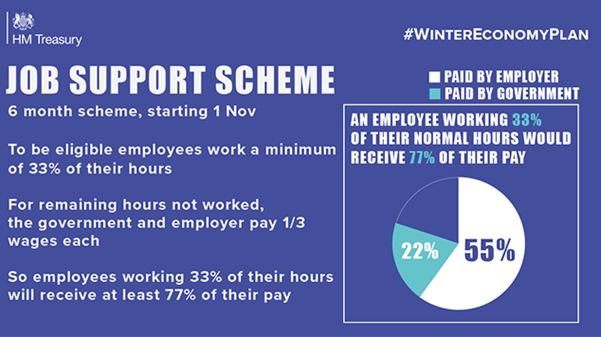

The employer will continue to pay its employees for time worked, but the cost of hours not worked will be split between the employer, the Government (through wage support) and the employee (through a wage reduction); the employee will keep their job.

The Government will pay a third of hours not worked up to a cap, with the employer also contributing a third. This will ensure employees earn a minimum of 77% of their normal wages, where the Government contribution has not been capped.

Employers using the Job Support Scheme will also be able to claim the Job Retention Bonus if they meet the eligibility criteria.

Who is eligible?

Employers

All employers with a UK bank account and UK PAYE schemes can claim the grant. Neither the employer nor the employee needs to have previously used the Coronavirus Job Retention Scheme.

Large businesses will have to meet a financial assessment test, so the scheme is only available to those whose turnover is lower now than before experiencing difficulties from Covid-19. There will be no financial assessment test for small and medium enterprises (SMEs).

It is the government’s expectation that large employers using the Job Support Scheme will not be making capital distributions, such as dividend payments or share buybacks whilst accessing the grant. Further details will be set out in guidance.

Employees

Employees must be on an employer’s PAYE payroll on or before 23 September 2020. This means a Real Time Information (RTI) submission notifying payment to that employee to HMRC must have been made on or before 23 September 2020.

In order to support viable jobs, the employee must work at least 33% of their usual hours for the first three months of the scheme. After three months, the Government will consider whether to increase this minimum hours threshold. The definition of ‘usual hours’ has still to be confirmed. However, it is anticipated to be similar for those on zero hours using flexi-furlough.

Employees will be able to cycle on and off the scheme and do not have to be working the same pattern each month, but each short-time working arrangement must cover a minimum period of seven days.

Employees cannot be made redundant or placed on notice of redundancy during the period of the Job Support Scheme.

Employers must agree the short time working arrangements with employees, as with furlough, and make changes to the employment contract and notify the employee in writing.

What does the grant cover?

For every hour not worked by the employee, both the Government and employer will pay a third each of the usual hourly wage for that employee. The Government contribution will be capped at £697.92 a month.

Grant payments will be made in arrears, reimbursing the employer for the Government’s contribution. The grant will not cover Class 1 employer NICs or pension contributions, although these contributions will remain payable by the employer.

“Usual wages” calculations will follow a similar methodology as for the Coronavirus Job Retention Scheme – full details will be set out in guidance shortly. Employees who have previously been furloughed will have their underlying usual pay and/or hours used to calculate usual wages, not the amount they were paid whilst on furlough.

Employers must pay employees their contracted wages for hours worked, along with the Government and employer contributions for hours not worked. It is expected that employers cannot top up their employees’ wages above the two-thirds contribution to hours not worked at their own expense.

What does it mean to be on reduced hours?

- The employee must be working at least 33% of their usual hours

- For the time worked, employees must be paid their normal contracted wage

- For time not worked, the employee will be paid up to two-thirds of their usual wage

How can you claim?

The scheme will be open from 1st November2020 to 30th April 2021. Employers will be able to make a claim online through www.gov.uk from December 2020. They will be paid on a monthly basis.

Grants will be payable in arrears meaning that a claim can only be submitted in respect of a given pay period, after payment to the employee has been made and that payment has been reported to HMRC via an RTI return.

Employers will not be able to make a claim until December 2020.

HMRC checks

HMRC will check claims. Payments may be withheld or need to be paid back if a claim is found to be fraudulent or based on incorrect information. Grants can only be used as reimbursement for wage costs actually incurred.

Employers must agree the new short-time working arrangements with their staff, make any changes to the employment contract by agreement and notify the employee in writing. This agreement must be made available to HMRC on request.

It is the government’s intention that employees will be informed by HMRC directly of full details of the claim.

Job Support Scheme Example

Beth normally works 5 days a week and earns £350 a week. Her company is suffering reduced sales due to coronavirus. Rather than making Beth redundant, the company puts Beth on the Job Support Scheme, working 2 days a week (40% of her usual hours).

Her employer pays Beth £140 for the days she works.

For the time she is not working (3 days or 60%, worth £210), she will also earn two thirds, or £140, bringing her total earnings to £280, 80% of her normal wage.

The Government will give a grant worth £70 (1/3 of hours not worked, equivalent to 20% of her normal wages) to Beth’s employer to support them in keeping Beth’s job.