Employment Allowance

From 6 April 2020 eligibility rules for claiming the Employment Allowance (EA) will change. After the 6th April 2020, only small businesses (with a NIC bill of £100,000 or less) will be eligible to claim the employment Allowance.

You will not automatically qualify for EA, you must claim it each tax year by submitting a declaration. If you become connected with an employer through resources such as staff or premises, you must reassess your eligibility.

The EA will be state aid and counts towards the maximum aid you can receive in a rolling three-year period. You must have room to accommodate the £3,000 EA within state aid limit or lose your entitlement to it.

If you are a Streets payroll client, we will contact you if you are going to be affected by these changes.

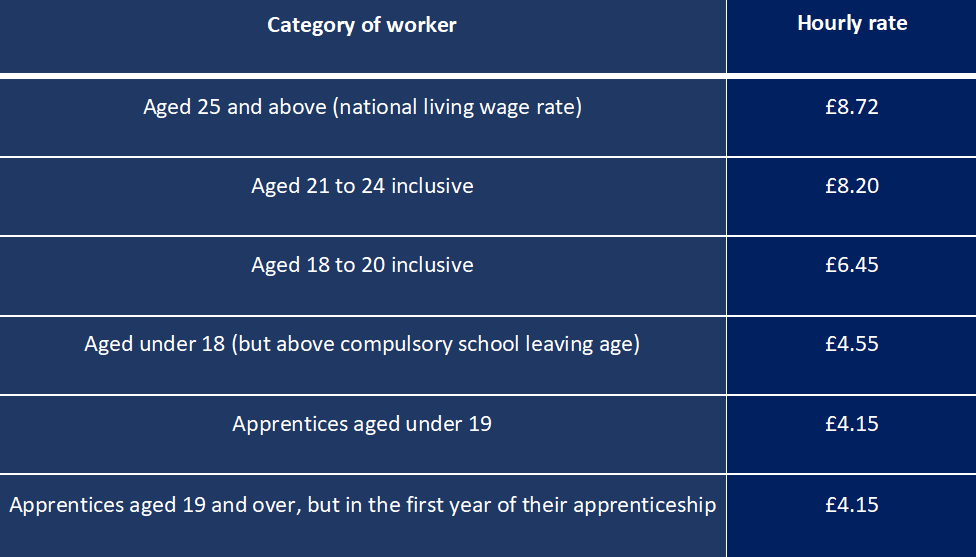

National Minimum Wage

The National Minimum Wage is set to increase from April 2020. The new rates are as follows:

Holiday Pay Reference Period

Almost all workers are entitled to 5.6 weeks paid holiday each year. This includes agency workers, workers with irregular hours and workers on zero-hours contracts.

However, where workers undertake regular overtime, or have variable hours, their holiday pay should be calculated using a reference period.

Currently employers should look back 12 weeks and calculate the average weekly pay received for that time. For weeks where no work was performed, and thus no pay earned, the week is discounted. The employer then looks back a further week until 12 weeks in which the worker was paid are counted.

From 6 April 2020, the reference period is being extended. Instead of looking back 12 weeks, employers need to calculate the average over a 52 week period.

As unpaid weeks are still excluded, this can require employers to count back over a year into the past. To avoid having to go back indefinitely, a limit of 104 weeks’ worth of data is being introduced; two full years. If after that, there is still not 52 weeks’ worth of data, the employer uses an average of what they have e.g. if in the past 2 years, the worker has worked in 46 weeks, that is the number of weeks’ worth of data used.

Similarly, if the worker has worked 60 weeks in the last 2 years, only the most recent 52 weeks would be included in the reference period. The changes also clarify what employers do with new workers; if they haven’t worked 52 weeks, they should use what pay data is available right back to their start date. For example, if a worker has been working with their employer for 14 weeks then takes leave, the employer should use the 14 weeks’ worth of data that is available.