As part of the measures announced to help businesses through the difficulties posed by the current Covid-19 pandemic, temporary changes have been made to VAT payments due between 20 March 2020 and 30 June 2020.

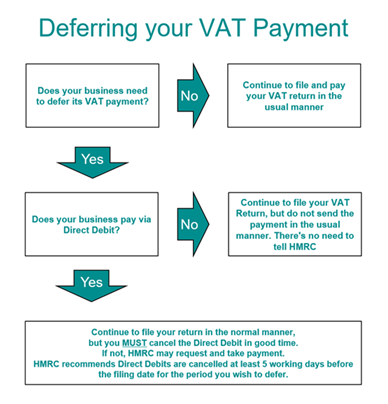

These are designed to aide cashflow by allowing the deferral of VAT payments. The flow chart below has been issued by HMRC to illustrate the actions required by businesses depending on how they pay their VAT.

Please note the following points:

- You do not need to apply for the deferral

- If you pay by direct debit please cancel this in good time i.e. at least 5 working days before payment to ensure this is not automatically taken

- The deferral does not cover payments for VAT MOSS or import VAT

- Deferred VAT payments must be paid on or before 31 March 2021

In addition to the VAT deferral, if you are having difficulties paying your liabilities then HMRC are advising:

“Time to pay arrangements are available to all businesses and individuals who are in temporary financial distress as a result of coronavirus.”

You should contact their time to pay services on 0300 200 3822 for Self-Assessment and on 0300 200 3835 for other taxes.

Full guidance of the VAT deferral is available on the HMRC website at https://www.gov.uk/guidance/deferral-of-vat-payments-due-to-coronavirus-covid-19