April brings a fresh set of opportunities to keep hold of more of your wealth.

Tax planning should be a year-round activity. But the start of a new tax year is an ideal time to assess whether you can make the most of the allowances and exemptions available. Here’s a rundown of what’s changed, what’s not changed, and some actions you should consider.

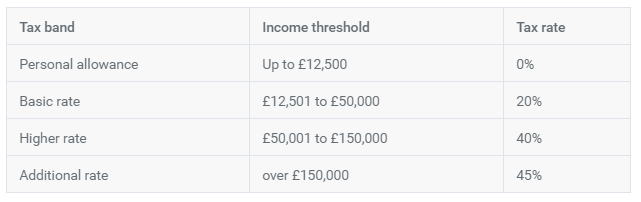

1. Income Tax

The personal allowance – the amount that you are allowed to earn before you start paying Income Tax – has risen from £11,850 to £12,500.

The higher rate threshold – the point at which you will start to pay 40% Income Tax – has increased from £46,350 to £50,000. The additional rate tax band of £150,000 remains unchanged.

There are a different set of changes for Scottish taxpayers. These can be found on HMRC’s website.

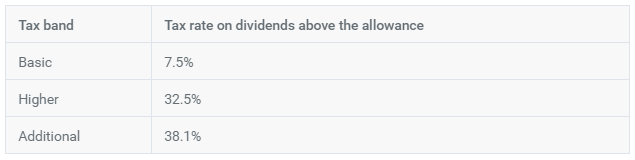

2. Dividend Allowance

For 2019/20, the Dividend Allowance remains at £2,000. That means you won’t pay tax on income generated from a share portfolio of around £57,000 held outside of an ISA or pension wrapper, based on a yield of 3.5%. The increased Income Tax thresholds outlined above mean that you can take more in dividends before paying the higher dividend tax rate.

3. Personal Savings Allowance

For 2019/20, basic rate tax payers can continue to earn £1,000 interest on savings before paying tax. Those paying tax at the higher rate see their allowance remain at £500. If you're an additional rate taxpayer earning £150,001 or more, you'll lose entitlement to any allowance.

4. Personal pensions

Most people can still get tax relief on pension contributions worth up to £40,000 per tax year (or 100% of earnings, if less). However, those with adjusted earnings of more than £150,000 will continue be subject to the ‘tapered annual allowance’ which can result in a maximum annual allowance of £10,000.

Documents published last month confirmed that a review of pension tax relief is still very much in the government’s sights. So it’s sensible to make full use of the current reliefs.

The Lifetime Allowance – the most you can take from your pension savings before triggering an extra tax charge – increased from £1,030,000 to £1,055,000 on 6 April.

5. Capital Gains Tax

The Capital Gains Tax annual exempt amount for individuals has increased from £11,700 to £12,000. Effective and repeated use of your CGT exemption is a great way to transfer assets into ISAs or pensions to provide a shelter from any future liability.

6. ISAs

The most you can put into your ISA remains at £20,000 for the 2019/20 tax year. This includes Stocks & Shares and Cash ISAs. This week’s news of a possible six-month delay to Brexit could be bad news for Cash ISA savers though, as it has pushed back expectations of further interest rate rises until the second half of 2020.

7. Junior ISAs

The Junior ISA allowance has gone up to £4,368. Alongside pensions, Junior ISAs present a great opportunity to help give children a financial head start.

8. Inheritance Tax

Everyone in the 2019/20 tax year has an Inheritance Tax allowance of £325,000 – known as the ‘nil-rate band’. The allowance has remained the same since 2010/11.

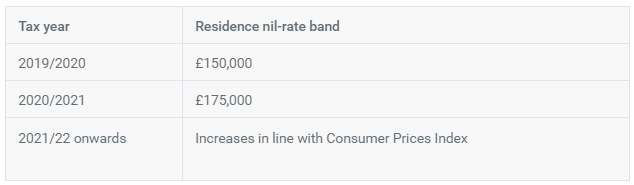

9. Residence nil-rate band

The new tax year sees the inherited property allowance – known as the ‘residence nil-rate band’ – rise from £125,000 to £150,000. Combined with the standard Inheritance Tax allowance of £325,000, the increase means you can now pass on as much as £475,000 to direct descendants tax-free. For married couples and civil partners that figure is £950,000. The rules are complicated, so getting advice is vital.

10. Entrepreneurs’ Relief

Entrepreneurs can continue to benefit from tax relief at 10% on up to £10 million of lifetime gains. However, as of 6 April, the minimum period throughout which the qualifying conditions for Entrepreneurs’ Relief must be met is 24 months rather than 12 months.

There are many planning points that are worth considering at the start of the tax year rather than leaving it until the end. If you would like a review of your financial planning, please contact Sam Tindale stindale@streetsweb.co.uk

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are dependent on individual circumstances.