GIFT AID SMALL DONATIONS SCHEME (GASDS)

Many charities know about Gift Aid but the Gift Aid Small Donations Scheme (GASDS) is less well known.

Donations made via Gift Aid mean charities and community amateur sports clubs (CASCs) can reclaim income tax which the donor has paid – worth an extra 25p for every £1 given on donations. It doesn’t cost the donor anything extra, but they do need to be a UK tax payer and complete a formal gift aid declaration for each charity they support.

GASDS applies to charities which already use the gift aid scheme and enables some charities to claim a 25p for every £1 given in small cash or contactless card donations (no cheques allowed!). The refund and claims process operates like gift aid but no individual declarations are required from donors. A charity must have claimed Gift Aid in the same tax year as it wants to claim GASDS.

The maximum amount of GASDS top up available is £2,000 a year, based on cash donations of £8,000. Whilst the overall amount recoverable remains unchanged, the maximum amount for individual each qualifying donation is increasing from £20 to £30, for donations made on or after 6 April 2019.

See the HMRC website for more details:

https://www.gov.uk/donating-to-charity

https://www.gov.uk/claim-gift-aid/small-donations-scheme

SMALL CHARITY TRADING EXEMPTION

It is a common belief that charities are exempt from corporation tax, but that is only true when certain conditions are met.

Charities can claim an exemption from corporation tax on any income arising from primary purpose trading i.e. delivering its charitable services as long as all the income and gains have been, or will be applied, for charitable purposes. Any other trading activities, such as those run solely to generate funds for the charity, are potentially subject to corporation tax.

HMRC announced in last year’s Budget that the small trading tax exemption limits for charities would be increased in April 2019, where the trade does not relate to a charity’s primary purpose.

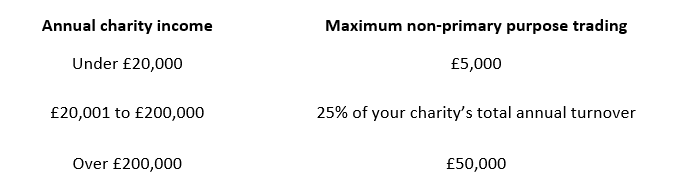

The present thresholds are:

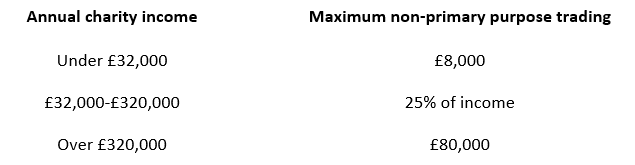

And these are being increased to:

The Charity Commission guidance “Trustees trading and tax: how charities may lawfully trade (CC35)” explains how a charity can trade itself, and when a trading subsidiary should be established.