Since 6th April 2016, high earners have been subject to a restriction on their annual allowance for pension contributions. The current annual allowance is £40,000, however for individuals with a taxable income of over £150,000 the annual allowance is tapered by £1 for every £2 over this threshold.

What is it?

The maximum reduction is £30,000 therefore anyone with an income in excess of £210,000 will have an annual allowance of £10,000.

The income thresholds given above are measured by ‘Adjusted Income’. It is not simply defined as an individual’s earnings but takes into account their entire remuneration package. Adjusted Income takes into account dividends paid to an employee as well as all types of benefits in kind including the premiums for an insurance paid for by the employer. This also includes property and investment income. On this basis, it is likely that a number of individuals who are subject to the restricted annual allowance are not actually aware of it.

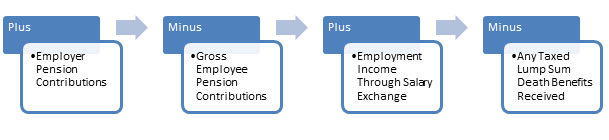

Adjusted Income is calculated as:

Taxable Income

(Include all earnings and taxable income)

Example

Louisa has taxable income of £145,000 in tax year 2017/18 and has a salary sacrifice arrangement in place under which her employer pays a total of £40,000 into an occupational pension scheme. Her threshold income is £145,000 and her adjusted income is £145,000 + £40,000 = £185,000, meaning she is subject to the tapered annual allowance. In this scenario Louisa could end up paying a tax charge of £7000.

The Impact

If an individual exceeds the annual allowance in any given year, they are liable to pay an annual allowance charge at their highest marginal rate of tax – essentially, cancelling out the tax relief that would have been received on the contribution.

While this has the potential to produce a likely large and unexpected tax bill, it can be addressed to mitigate the future impact. It is important to be aware of the restricted annual allowance as a potential tax planning issue and look to include this in any financial reviews as this can largely be planned for, however it is very difficult to mitigate retrospectively.

The Opportunity

For those affected, it is possible to plan and implement a strategy to maximise the reliefs available. For individuals who are in control of their own income, an alternative remuneration structure can be implemented. For those who are employed, it is possible to consider alternative strategies to minimise the impact of the restricted annual allowance.

It is also possible to carry forward any unused annual allowance from previous years and where a full annual allowance was available in a previous year, the full amount of carry forward would still be available. Likewise, where the restricted annual allowance was unused in a previous year, the unused amount could be carried forward.

We would advise all individuals who think that they could be affected by these rules get in touch with us to find out how we can help them.